Gentle Reader

SWMBO and I will be celebrating her birthday and taking two weeks off to stiffen my practice resolve.

I will miss an issue or two – the attached is short as is my time at present; there is also a paucity of interesting news, given the ad nauseam speculation on our impending election.

Regards

Daan

Practice

a News:

- RAF (en route to newsmaker of the year)

- The RAF has a backlog of 321000 claims.

- The application to review the AG’s disclaimer of the RAF’s 20/21 annual financial results, has been set aside. The RAF reacted to this judgement by stating that the court had misdirected itself as to the facts before it. Clearly not making friends!

- The office of the Public Protector has laid bare the details of how Mkhwebane spent money – royally.

- A note from Judgesmatter holds that there is a backlog in Concourt judgements which gives rise to concerns for a need for reform?

- The NPA has offered dispute resolution to firms facing criminal charges. Presumably, a prosecutor only does this as a last resort, which says much about the NPA’s ability to prosecute at this level and presumably a heavy caseload.

Hard news:

- A restraint of trade is only enforceable insofar as it protects a former employer’s specific and identified interests: https://www.ensafrica.com/news/detail/8400/the-enforceability-of-restraint-of-trade-clau

- Piercing the corporate veil in terms of section 218 (1): http://www.saflii.org.za/za/cases/ZASCA/2024/60.html

- A claim for sexual harassment amounts to a debt under the Prescription Act: https://fwblaw.co.za/a-debt-of-the-past-against-a-foe-for-a-lifetime/

- One cannot hold another to contractual performance if one does not perform fully those obligations which are yours: http://www.saflii.org.za/za/cases/ZASCA/2024/58.html

- If the defendant resides in South Africa, our courts have jurisdiction? Perhaps not – take a look: https://www.financialinstitutionslegalsnapshot.com/2024/04/residence-of-the-defendant-in-south-africa-alone-does-not-necessarily-confer-jurisdiction/

- There are several reported upon judgements by the Concourt which are simply not available on Saffli. I cannot help but wonder why?

Conveyancing/property

- An application by a bank, to declare residential property specially executable, must comply with set requirements in terms of the High Courts’ Directive 33 A: do look at clause 8 of the attached decision: http://www.saflii.org.za/za/cases/ZACC/2024/2.html

- CRC 1/2024 has been withdrawn and substituted by CRC 2/2024. Ask me for a copy.

- When is a waiver of a condition that one must obtain finance for a property valid?

https://www.saflii.org/za/cases/ZASCA/2024/46.html ex STBB

Property

Trends:

Sapoa reported a small decrease in general office vacancy nationally. Prime-office vacancy is doing relatively well at 8.8%. Johannesburg boasts quite a respectable office vacancy rate at 7.3%.

News:

- A new mall is under construction near Louis Trichardt (Makhado). A gentleman/my erstwhile boss with many years as estate agent in that area, has doubts about the mall’s viability. Time will tell.

- Sandton Gate, Phase 2 is under construction.

- Much has been written over the years on the construction mafia; the following article suggests how this destructive grouping can be combated: https://dailyfriend.co.za/2024/04/15/the-high-cost-of-the-construction-mafia-and-how-it-can-be-faced-down/

- Can you keep animals in a sectional title scheme? https://www.millers.co.za/OurInsights/ArticleDetail.aspx?ArticleID=6774&utm_source=EV&utm_medium=email&utm_campaign=MILL_Newsletter_April24_Issue_02&utm_term=https%3A%2F%2Fwww.millers.co.za%2FOurInsights%2FArticleDetail.aspx%3FArticleID%3D6774

- A purchaser in a sectional scheme has an automatic right to resile from a contract if there is a right to extend the scheme which has not been disclosed to him on purchase. Dealing with this right becomes awkward in KZN as the interpretation here is that such a right exists, even if fully worked out but not cancelled on the sectional plans.

Economy/Business

Trends

- The IMF predicts our medium-term economic growth at 0.9% – the Reserve Bank is optimistic at 1.2%.

- Our CPI sits at 5.3% – Ninety One says that our household inflation is higher than this, at some 9.1%.

- The consensus is that our bank rate will not come down in the first half of this year – this has raised comment that our Reserve Bank may be holding interest rates unnecessarily high.

- Whilst on this topic – the SARB has added two new measures to “better understand the underlying price pressures.” A precursor to change? This

- Much has been said about our tourism figures improving, but a Moneyweb write-up holds that our foreign tourist numbers are sitting at 2010 levels.

Tax:

- Fluxmans published a note on bracket creep/fiscal drag and the simplest take-away from this is that the failure to adjust tax rates would cause a taxpayer earning R350k pa, who had received a 6% salary increase in line with inflation, would be paying 5% more tax than last year.

- The Capitec/SARS dispute has clarified free of charge supplies as non-vatable.

Our bourse: the JSE is set to reigning in the flight of small-cap companies from its listings.

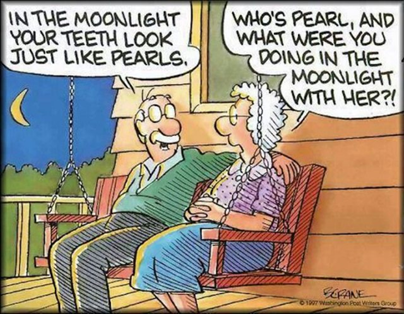

Lighten up

On SWMBO’s impending birthday:

- “At age 20, we worry about what others think of us. At age 40, we don’t care what they think of us. At age 60, we discover they haven’t been thinking of us at all.” Ann Landers

- “Old age isn’t so bad if you consider the alternative.”

Maurice Chevalier

Written by: Daan Steenkamp

https://www.daansteenkampattorneys.co.za/

Still looking for your dream home, or wanting to sell? Feel free to give one of our developers a call today.

Tom Eastwick – The Gates, Hilton and Garlington, Hilton | 072 297 2699 | tom@devdirect.co.za

Janet Channing – Waterford Residential Estate, Howick | 082 570 5834 | janet@devdirect.co.za

#retirement #gatedestate #luxuryliving #midlandsliving