Gentle Reader

This will be my last newsletter for a few weeks as I will shortly depart to go dirt-biking in Georgia (the country) with our sons.

I suspect that our regular family flings (for the sensitive amongst you, bonding) is about to be curtailed by the romantic attachments formed by my sons (now demonstrably heterosexual) and, no doubt, introspection, laced with need, fear (any married man understands these) and wisdom, will follow. Georgia claims the genesis of winemaking as its own and I have little doubt that wisdom will be forthcoming.

Regards

Daan

Economy

Two independent, but related economic articles, were floated this week past: the first a note that the production cuts in China had put pressure on iron ore prices; the second a broadening of this result into a curtailment of the runaway commodity prices (also prompted by slower growth in China) that saved our financial bacon recently. The World Bank estimates that the Chinese economic growth will slow from 8.5% this year to 5.4% next year, dragging down the rest of the world with it, particularly “commodity -dependent countries” like ourselves. The prediction (Moneyweb) goes further to speculate that the biggest commodity super cycle in history is probably coming to an end. Even worse, an overshoot i.e., not just a reversion to mean prices, but a dip into the downside, may be expected.

̃

Another interesting note was a calculation of the cost of containing violence, by governments, made by the Institute for Economics & Peace which estimates that South Africa had spent an annual containment cost equal to 12% of our GDP in 2019, compared to peaceful countries which spend some 3% of their GDP on this. The impact of the unrest in July, could reduce our GDP this year by 0.8%.

̃

The debate on the independence of the Reserve Bank is largely ignored of late: Angola, believe it or not, is in the process of addressing the excesses of its previous governance and – wait for it – institutionalising the independence of its central bank.

Business

A few notes in passing:

- Mango is in voluntary business rescue (yawn).

- Bank Zero has opened for business and promises no-fee accounts; a crowded market of late, with ThymeBank, Discovery Bank and African Bank having floated some offerings in this space.

- The Sharemax auditors have taken on their upcoming Irba hearing based on bias (Mr Zuma should be given more credit for his contribution to South African law).

- An unexpected result of last year’s Covid impact on business was a 32% leap in new company registrations with CIPC – a record number of registrations, caused by South Africans forming companies, driven by necessity after losing jobs. That this is so, is bolstered by statistics from the Small Enterprise Foundation, of a 6% y-o-y increase in first-time borrowers, “which is a proxy for people starting new businesses”.

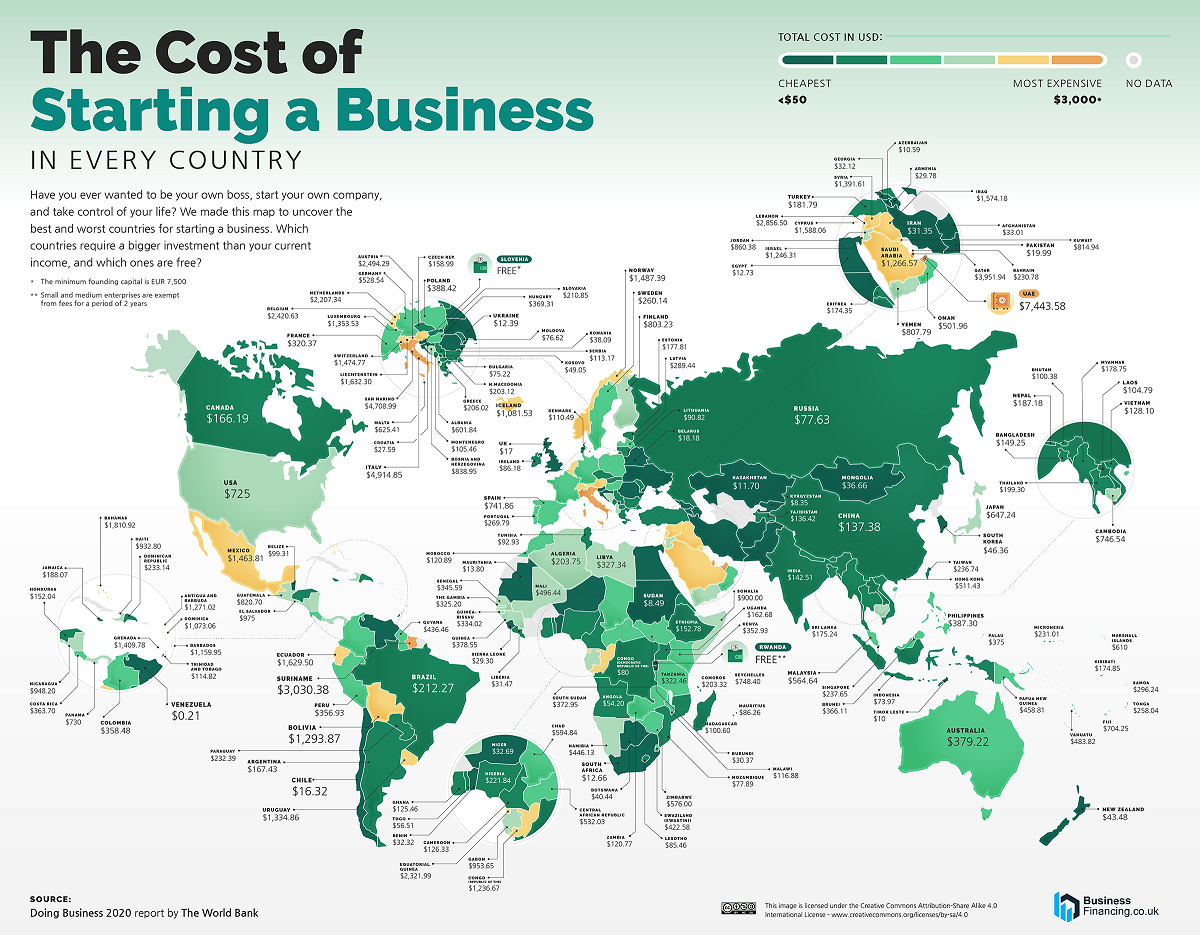

- Whilst on the topic of starting a business – here is a comparison of what it takes in each part of our world – we whinge but it is less expensive here to start a business than elsewhere (ex SWKE):

On the vexed question of working together:

- how to build a team: https://ideas.ted.com/the-3-things-that-great-teams-have-in-common/; and

- how to develop a company culture that brings out the best in workers: https://ideas.ted.com/3-ways-to-create-work-company-culture-brings-out-best-in-people/

̃

Finally, the Medupi bugger-up that took place this week may cost up to R40bn: I gather that in 2013 just UK and US enterprises were losing an estimated $37bn annually. Perhaps we should record and rank the cost of these slipups – with this one, we would be right up there!

Practice

Hard news:

- An interesting article appeared in the De Rebus on a grand parent’s responsibility for the maintenance of a grandchild: https://www.derebus.org.za/grandchilds-claim-against-grandparents-estate-weighing-up-child-maintenance-against-freedom-of-testation/

- Virtual offices are here with a vengeance: I hold an article on online contracts and the reasonable expectation of a consumer who will probably not read the contract to be signed by; by Prof van Deventer, SALJ: ask me for a copy.

- Muslim marriages are not necessarily recognised in South Africa; children born of such marriages could thus be “illegitimate”. What rights would such a child have against his parents? https://journals.co.za/doi/pdf/10.10520/ejc-obiter-v42-n1-a8

̃

Would a business be entitled to sue our government for losses attributed to riots which could reasonably have been prevented? This is going to be interesting: https://citizen.co.za/news/south-africa/politics/2590373/action-sa-lawsuit-anc-cabinet/

See also: http://www.dejure.up.ac.za/images/files/vol54-2021/Chapter%208_2021%20Maseko.pdf

̃

I had the occasion to discuss the antics of a colleague, who had misappropriated a large sum of money, with a colleague facing a similar dilemma, as I did not think that the said antics were possible. The interesting thing was that neither did my colleague, and one can only assume that the scrupulously honest are unaware of the possibilities presented, if one is prepared to bend the rules. But then, I’ve had partners like those.

̃

Speaking of partners: if your intent is to foster and maintain a limited boutique-style practice, you can indulge in taking on-a yes-man as a partner; if your intent is to grow, you need to encourage diversity and manage that diversity. The fact is that the greater the diversity of your partners, the greater the reach into potential clientele. This is probably the strongest argument for racial inclusivity.

Property

Shipping out? The FNB Property Barometer report that 21% of home sales in the second quarter of this year may be attributed to financial pressure; 22% to immigration or relocation. The difference between asking and selling prices is about 8%.

Comment

The impecunious Mr Zuma might well benefit from being treated by state physicians, after all, it’s free! Having said that, in Mr Shaik’s case, that gentleman recovered remarkably after his treatment was taken over by private physicians and the same might hold true for Mr Zuma.

̃

I was fascinated by a report that the SADF had been deployed to guard the SABC: in times of insurrection, control of the media is paramount. So, does Mr Ramaphosa expect another uprising or is the SADF just late in arriving for the first insurrection?

̃

Orania bo! Some eleven years ago SWMBO and I were sitting on a boat in the Krka National Park, Croatia. With us was a just-married Croatian couple. He asked about politics in South Africa, and I explained. He asked why we (whites) tolerated staying with blacks in the same country. In essence, I said that the issues were complicated. His response was that in their country they had sorted out this issue, expelled all the unwanted persons and that they were virtually ethnically pure. A similar sentiment has resurfaced here: this is the result of the poll conducted by CIAG on Western Cape independence:

- 89%of respondents believe South Africa (SA) is going in the wrong direction.

- 33%said they have considered emigrating as an alternative to SA’s chaos and corruption.

- 73%believe that the Western Cape is better managed than the rest of South Africa.

- 59%of those who expressed a preference believe that their lives would improve in an independent Cape, and 75% affirmed their support for non-racialism

- 76%believe the province must have more control over its own policies.

- 62%would prefer less economic interference by government and support the privatisation of key services.

- Respondents identified improvements in employment, education, health and crime prevention as their main motivation for Cape Independence.

https://www.capeindependence.org/post/new-ciag-poll-on-cape-independence-2021

And you thought only the Durbanites were smoking something…

But then, watching Sascoc (the unready) scrambling to reward our gold medallists from non-existing funds, I’m tempted…

Quotables

“Yet another victim of the fires. We are losing our history, our identity is turning to ashes, our soul is burning,” Giuseppe Falcomatà, the mayor of the Calabrian province Reggio Calabria in response to the fires in Italy following on a recordal of the hottest temperature in European history.

̃

The trouble starts when those elected to leadership, by the popular vote, fail to deliver on promises but still need the vote to retain power.

Barnes

Lighten up

Q: What do you call money that grows on trees?

A: Marijuana

̃

Police Officer: “How high are you?”

Pothead: “No officer, it’s “Hi, How are you?”

̃

Author: Dr Daan Steenkamp

Still looking for your dream home. Feel free to give one of our developers a call today.

Tom Eastwick – The Gates, Hilton and Garlington, Hilton | 072 297 2699 | tom@devdirect.co.za

Janet Channing – Waterford Residential Estate, Howick | 082 570 5834 | janet@devdirect.co.za

#retirement #gatedestate #luxuryliving #midlandsliving