As South Africa continues to struggle with frequent power outages and rising energy prices, many property owners are looking to source alternative energy solutions to remain operational. Among the available options, rooftop solar has become the most popular choice. It comes as no surprise considering solar technology requires minimal maintenance, with most of its components being highly durable, with a long lifespan, and it offers a manageable total cost. The main advantage for property owners is that solar ensures a continuous electricity supply which they can rely on in the day-to-day running of their business (or to be consumed by their tenants) while it also shields them from NERSA tariff increases which are expected to rise exponentially in the future.

So how are businesses funding the capital outlay?

For businesses that have not budgeted for the capital expenditure or would prefer not to self-finance the solar installation, several options are currently available in the market, the question is which is the most cost effective. These various options include:

Entering into a Power Purchase Agreement

A popular option for businesses is to enter into Power Purchase Agreements (PPAs). PPAs regulate the contractual relationship between the power producer and the energy consumer and cover the cost of electricity, terms of the contract, payment terms etc.

Pros:

– Minimal upfront cost

– Stable cost with predictable inflation linked increases

– Maintenance and monitoring are the responsibility of the power producer

– Payments made in terms of the PPA are fully deductible for tax purposes

Cons:

– Long-term commitment

– The energy consumer doesn’t qualify for the Section 12B tax incentive

– Ownership of the assets rests with the power producer

Rent-to-own arrangements

Another viable financing option is a rent-to-own arrangement. As with traditional lease agreements, rent-to-own arrangements are a legally binding contract between two parties – the lessor (owner of the assets) and the lessee (the party using the asset) – that outlines the terms and conditions for leasing a solar system. The lessee pays a fixed monthly lease payment, which is typically reviewed annually. However, at the end of the term, the asset is transferred to the lessee.

Pros:

– Minimal upfront cost

– Stable and predictable costs

– Maintenance and monitoring are the responsibility of the lessor

Cons:

– The total cost of ownership can be high over the long term

– Long-term commitment

– The energy consumer doesn’t qualify for the Section 12B tax incentive

Debt funding

Raising debt funding from a financial institution is an option for businesses. Typically, financial institutions will offer up to 70% debt funding on solar assets. This means that the end customer would need to have up to 30% available capital. In other words, on a R10 million installation, the business would need R3 million in capital available to raise the remaining R7 million from the financial institution.

Pros:

– Ownership and control

– The energy consumer does qualify for the Section 12B tax incentive

Cons:

– Only interest payments are tax deductible

– Large upfront capital outlay

– Maintenance and monitoring are the responsibility of the corporate

Accessing funding from Section 12B Funds

Following the recent enhancement to the Section 12B tax incentive, fund managers, such as alternative investments specialist Jaltech, have raised retail capital from South African taxpayers whose capital is mandated to fund solar projects in South Africa. Given the large tax incentive for investors, Jaltech is able to offer funding to property owners at rates which are significantly more attractive than the options mentioned above. For instance, Jaltech is able to fund the entire project while banks are only willing to fund 70% of the project.

Pros:

– Minimal upfront cost

– Stable and predictable costs

– The property owner will be able to appoint the EPC/installer

– Maintenance and monitoring are the responsibility of the appointed EPC/ installer

– 100% funding is available

– Funding off balance sheet

– The funding term can be as long as 15 years, lowering the annual payment

– The annual cost will over time be lower than the cost of purchasing electricity from Eskom

– All payments are tax-deductible

Cons:

– Long-term commitment

– The energy consumer doesn’t qualify for the Section 12B tax incentive

The prospect of Eskom supplying the South African market with reliable electricity, within the next two years, is remote and when they eventually achieve this, the cost of the electricity would most likely be significantly higher than the cost of producing energy through solar. Businesses should, therefore, be exploring alternative energy solutions as their adoption is inevitable.

Commercial property sector to the rescue

SA’s commercial property sector can solve South Africa’s loadshedding problem, says a study.

South Africa’s commercial property industry could virtually eliminate loadshedding in the country – at least during daylight hours – while providing an overdue boost to its returns, according to a study by commercial real estate software and data services company Gmaven.

Retail, office and industrial properties in the country’s five major cities have 68.7 million square meters of rooftop without any solar, according to the analysis, which used satellite imagery and in-house data. By installing solar panels on just two-thirds of commercial properties in tier-1 (SAPOA) nodes in the five major cities, the country could boost its power generation capacity by 4.7GW – the equivalent of nearly five stages of loadshedding.

East Rand Mall solar installation. 1726 kWp Cost R19 million

This assumes a 60% utilisation rate of that rooftop space, and factors in a 19% loss rate from converting solar energy to alternating current.

While a programme of this scale would cost the commercial real estate industry between R45 billion and R55 billion, the investment promises to generate annual electricity cost savings of R18 billion – a figure that would escalate each year as Eskom tariffs climb.

“Excluding batteries and loadshedding, that translates into a yield-accretive investment return exceeding 25%,” says Gmaven CEO Will Harris. “For the commercial real estate sector, it’s a modern-day gold rush.”

Gmaven CEO Will Harris

And property owners are not sleeping on the opportunity. For example, Resilient REIT, which has a retail-heavy portfolio, plans to have 68MW of installed capacity by the end of 2023, while Growthpoint Properties aims to have 46MW installed by

2026. Redefine is currently underway with expansion, for a total capacity of 45MWp in the near term.

Room to grow

However, the study found that just 6.4% of the 41,000 retail, office and industrial properties in South Africa’s 93 tier-1 SAPOA commercial nodes currently have solar panels installed on their roofs. Larger properties are more inclined to have solar

– by rentable area, 15.6% of properties are solar powered. The retail property sector is leading the way, with 20.6% of lettable area being solarpowered.

The office segment is the laggard – only 12.5% of office space has solar. Industrial, at 43m square meters, three times that of retail, provides the most available roof space.

However, with warehousing’s low electricity consumption, in the absence of attractive feed-in tariffs / wheeling by municipalities, many large rooftop solar installations would be wasted.

Everyone’s a winner

“By making feed-in tariffs commercial property friendly, property owners can be enticed to produce power for others, and become part of the energy solution in South Africa,” Harris says. Such a programme would significantly boost job creation and skills training in both the installation and maintenance phases. It would also help to shore up finances at municipalities that offer appropriate feed-in tariffs.

“Unlike in the residential space, the commercial property sector’s major electricity consumption is during daytime hours. This overlaps with maximum sun. In other words, the industry’s peak power needs are broadly matched by peak solar radiation.”

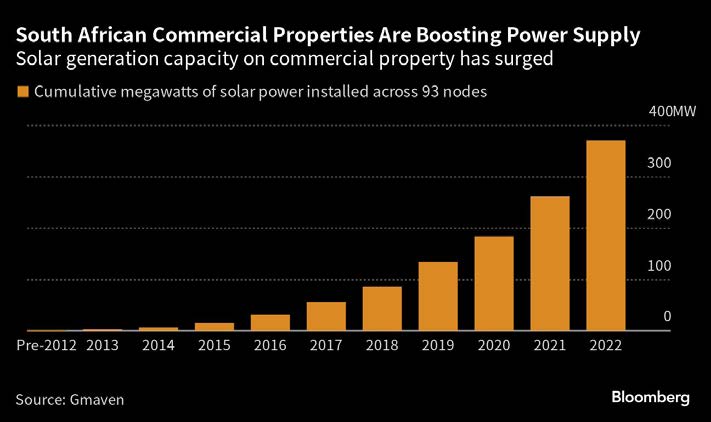

While rooftop solar has grown by a compounding 46% year-on-year over the last five years, it still has 13 times more room to grow. And Gmaven is confident it will.

Medupi Power Station is a dry-cooled coal-fired power station near Lephalale in Limpopo province.

Solar vs Medupi?

The controversial Medupi, the world’s biggest dry-cooled coal-fired power station, started development in 2007. At 4.764GW it should produce roughly the same output as the 93 SAPOA nodes – or around 1/6th of South Africa’s peak power demands on Eskom. But this is where the comparison ends.

At a capex of around R250B and growing, Medupi is around 5X the cost of solar, for the same output. Its cost of power, at 2016 coal prices, is R1.05 / kWh – 50% more than that of solar – priced before the profit margins of local municipalities.

Meanwhile carbon emissions from coal are roughly 19X greater than solar. Currently, Medupi’s output is estimated at a sad 2GW. Saying this, Medupi can produce power all day, while solar (without power storage)only produces during peak sun.

Source: Asset Magazine

Still looking for your dream home, or wanting to sell? Feel free to give one of our developers a call today.

Tom Eastwick – The Gates, Hilton and Garlington, Hilton | 072 297 2699 | tom@devdirect.co.za

Janet Channing – Waterford Residential Estate, Howick | 082 570 5834 | janet@devdirect.co.za