Economy

2023:

- Predictions by world financial giants are that this year will bring a global recession. This should bring dampened inflation and a halt in interest-rate rises. If this does happen, the dollar will probably strengthen, it being seen as a safe haven in turbulent times.

- South African GDP forecasts are, given the Eskom disaster, for 1% or less growth. This places us below countries such as Nigeria and Angola in terms of growth.

- South African equities:

- FNB had, 10 days ago, predicted a good year for South African shares.

- Au contraire, Wierzycka opined that our equities do not represent great long-term value, given our political risk – she advocates investing offshore. The difficulty with this is that overseas stocks are on a high.

- Easy Equities entered our market in 2014 and has become our preferred online share trading platform with more than twice the number of respondents preferring this platform to that of Standard Bank and FNB. It’s selling points are a patented fractional share rights model which allows investors to buy and sell small portions of equities traded on stock exchanges as well as an easy-to-use interface.

- Interestingly, our consumer confidence index recovered from – 22 to – 8. Better, but still depressed. The reason for this is probably owing to strong third-quarter growth for agriculture, construction and mining. Whether this recovery will endure is debatable, given the flood of negative information coming through on the unavailability of electricity.

Banks & currency:

- African Bank wants to list in 2025. The intent is to build on the “underserved” consumer market – read “bottom end” – to create “a compelling listing proposition”. Big steps for an entity on the rebound from curatorship.

- Our Minister of Finance mooted a fully-fledged state bank by merging the Post-Office with African Bank. The intent is to provide loans to the “gap market”– those who earn too much to get RDP houses and too little to get mortgages from banks. Rich for those who cannot get the Landbank to work and now wants to move into even riskier investments.

- The ANC (again) proposes to expand the Reserve Bank mandate to “meet the needs of the economy” (read do more to support the domestic economy). Part of the difficulty with this is the constitutional entrenchment of that bank’s mandate and its ownership. Would you hand over such a crucial institution to someone who has just sunk an economy?

- DeFi: stands for decentralised finance and the intent of investors to take advantage of financial markets without the need for a bank. Get used to the term.

- Crypto turned out to be great for gambling but lousy at liberating our money from big central banks. With the unfolding US/Luno drama and the FXT scandal, one would be forgiven for assuming that a crypto winter is on hand. The difficulty with such “investments” remains that there is no one who can be held accountable when something goes wrong.

- Whilst on Crypto – this is our tax situation vis-à-vis this asset: https://www.webberwentzel.com/News/Documents/2022/122206-tax-chronicles-monthly-issue-53-December-2022.pdf

Our government needs to buy more votes and has therefore dusted off its plans for land reform and welfare grants. It speaks of fine-tuning its policies. Fine-tuning my ass, this is simply a restatement of existing failed policy for the benefit of those who believe. We simply don’t have the money for this exercise, desirable as it may be – we have four times as many grant recipients as we have taxpayers. We need to accept that economic growth and development is the only sustainable method of dealing with poverty in this country. This cannot be achieved by greater redistribution as there is simply not enough to redistribute. The difficulty with where we are now, is that it has become clear, vide the current economic disaster which developed under the management of the ANC, that this self-styled august grouping simply does not have the insight and ability to drive the change that is required.

Eskom:

This overthrower of our State, under the portfolio of Gwede Mantashe, who, incidentally, cannot been blamed in any way for the bugger-up that has ensued but who is now placed to have direct oversight over Eskom, has plumbed new depths with all manner of revelations coming to the fore, such as:

- the CSIR saying that even if more capacity was added to our network, our network would not cope. In fact, fewer than one fifth of the renewable energy projects mooted, will go ahead owing to this constraint (one wonders whether Min. Mantashe considered this in his enthusiasm to link up Karpowerships?).

- The re-infusion of “old” skills into Eskom being blocked by trade unions and an inability of politicians to acknowledge that the incumbents simply don’t have the necessary insight and skill to sort out our self-induced problem;

Yet, our Minister of Finance, has said that this crisis will only last another 18 months. Perhaps he knows something that we don’t understand – it could even be the other way round? Time will tell.

The fact is that the impact range of this disaster touches virtually every business and industry in South Africa and will undoubtedly go down as an unparalleled financial disaster in our history.

The absurdity of the denials we are faced with from those who govern is staggering. The grand standing in the face of disaster is amazing: take min. Mantashe signing up 13 additional REIPPPPP projects (I will kiss your ass if you know what the acronym stands for) up in December with great flourish; an acknowledgement of failure posted as progress. Yet, few of us would wish for another government – the potential alternatives are undoubtedly worse.

Business

There is, unexpectedly, quite a lot of business news that developed over our festive season; what follows is a summary of the interesting stuff:

- Only 2.2 million TV licence holders had paid their TV licences the year before last. Now, the SABC board wants other players, like MultiChoice, to assist with collecting these taxes. Remarkable, isn’t it: the answer is quite simple, but politically not acceptable, and now those entities who do control their payments must assist to pay for those who cannot.

- Cannabis is widely used for treating pain, but studies show that it is no better than a placebo for this purpose. Incidentally, the use of this substance in the workplace may get you fired.

- DataQE has published the 2022 SA Banking Sentiment Index: remarkably FNB has shouldered Capitec aside as the most favoured bank, with Standard Bank last.

- Agbiz has proposed the creation of a state-owned and controlled entity to participate in the carriage of exports and imports as a preferred national carrier. Remarkable, actually suggesting the creation of another SOE!

- Who says that Italy has the monopoly on mafia? The expansion of illicit trade has had a massive impact on SA retailers. Furthermore, there is unprecedented interference with our supply chain systems. Another example is the extortion faced by big mining companies who, unless they employ who these groupings suggest, face the derailment of trains, blocked roads, burnt vehicles and so on.

- A 24-hour failure of the system, through which air traffic controllers transmit messages to pilots as an alternative to voice communications, this December, led to the disclosure that the alternative communications system i.e. high-frequency radio over the Johannesburg Oceanic region, had been out of action for at least six months. Fortunately, pilots were able to use satellite phones…. Wonderfully, this is described as a “challenge”!

- Johnson & Johnson has dropped talcum powder made from talc in favour of a similar product made from corn-starch, owing to thousands of lawsuits accusing that powder of causing cancer.

- Takealot is taking strain owing to others impinging on its once dominant market position.

- The competition watchdog announced that it has uncovered decades of price-fixing amongst insurers. This appears, at present, to include Sanlam, Old Mutual, Hollard, Momentum, Discovery, PPS, BrightRock and Bidvest Life.

- SARS has moved against intra-group loans: https://www.sars.gov.za/wp-content/uploads/Legal/Notes/Legal-IN-127-Determination-of-the-taxable-income-of-certain-persons-from-international-transactions-Intra-group-loans.pdf

- The 80% matric pass rate of government schools, compared to the 98% IEB pass rate, has prompted calls to improve the matric pass rate and put public schooling on par with private school counterparts. A bigger challenge than one might think, given that the one system has a 50% pass hurdle and the other 30% (which, together with grade-inflation, keeps reputations intact). The parlance is that one does not fail (that being, presumably, derogatory) – one “insufficiently achieves”!

I had addressed the issue of so-called quiet quitting before, but the conversation will not die – presumably because such conduct is rife in business. At one time one would simply fire the individual – these days we are offered (wonderful terminology, not so?) hard yard solutions to gatekeep this detrimental behaviour. See two thirds down the following article: https://www.news24.com/life/Wellness/Mind/quiet-quitting-is-a-slow-death-to-everyone-concerned-heres-how-to-curb-this-detrimental-behaviour-20230119-2

Property

Two national noteworthy developments are on the cards:

- A R1bn luxury mall, to be named Oceans Mall in Umhlanga; and

- The R84bn Mooikloof Mega City east of Pretoria.

The latter is a public/private collaboration with the developers Balwin Properties.

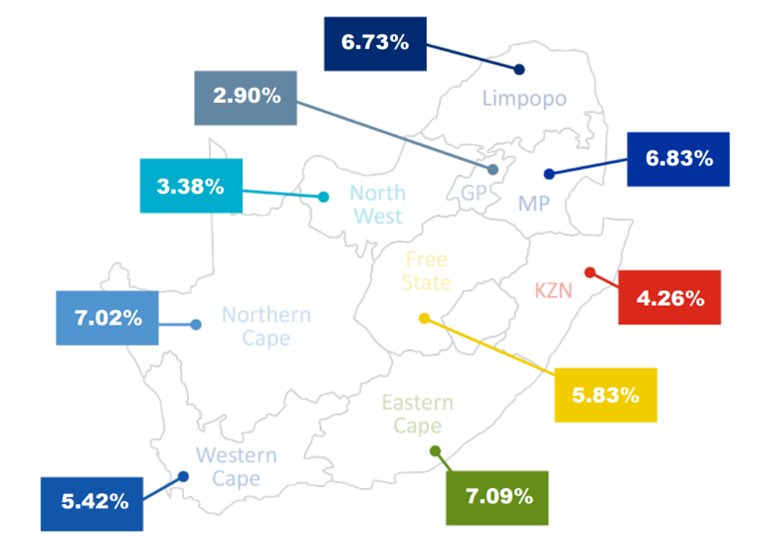

Most of us are more concerned about the prices of existing properties than new developments that come on the market. Lightstone says that low-value properties are seeing price hikes at much higher levels than other segments of the property market. The average annual year-on-year house price inflation for last year was set at 2.74%, a consistent decrease on the previous year. This rate remained steady in KZN and Mpumalanga, increased in the Free State and Limpopo, and decreased further in the Eastern Cape, Gauteng, North West, the Northern Cape and the Western Cape. Inflation for properties in the low-value segment was 9.1% – see the following graph:

Higher cost of living and increased interest rates have eaten into the demand for homes and the prediction is (Rode) that the housing market will continue to slow.

Other trends in the residential property market are:

- semi-gration to the Western Cape (nine out of ten of the country’s top suburbs are situate in the Western Cape);

- silver semi-gration, older buyers migrating to small towns on the Garden Route;

- going green and outing (going off the grid);

- ensconcing oneself in estates;

- working from home;

- co-living/multi-generational living to save costs; and

- moving to save transport costs to school/work (we have few effective public transport systems).

Insofar as commercial property is concerned, Loos has commented on the big dips in property market sales and capital values prior to last year. Last year the market was, in his as good as it is going to be for the time being. His take is that our slowing economic growth will translate into slower expansion rates of businesses, a slackening in tenant demand and all-round slower activity, with low single-digit capital growth, which will not keep up with inflation.

The following might be of interest to readers:

- Roomsta is a website, marketing backrooms in both lani and Township areas and caters for affordable accommodation for those needing to move into urban areas.

- When is a homeowner liable for injuries caused by his electric fence? https://www.golegal.co.za/electric-fence-injuries/

- Can a homeowner intrude on the privacy of his neighbour with CCTV installations? https://www.golegal.co.za/cctv-home-privacy/

- The Sectional Titles Act has been amended and the practical effect thereof is summarised in the following article: https://businesstech.co.za/news/lifestyle/650199/new-laws-for-sectional-titles-and-complexes-in-south-africa-what-it-means-for-residents/

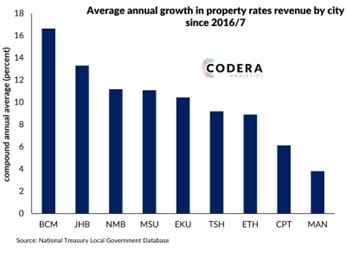

Local authorities are under financial pressure: the following graph gives the annual growth in property rates by city:

Practice

News

- AI has developed to the point that a bot, built by a US practice, managed to pass the local bar exam: https://futureworld.org/mindbullets/let-ai-be-the-judge/

- CJ Hlope was eventually suspended, and, to my knowledge, no challenge, Zuma-style, has come.

- Judicial overreach? Much was said about the purported suspension of our Public Protector where our High Court set aside such a decision by our President. Primarily comment on this came from Pierre de Vos. This sets the stage for the latest engagement where the DA takes on the ANC over cadre deployment. My sympathies lie with the former, but I confess to qualms on whether our courts should engage politicians for their rationality rather than that they be punished via the ballot box (yes, yes, the latter, given our population make-up is unlikely, but still…). Oh yes, taking on the State in court on bad governance, leading to load shedding, is another such instance. Pragmatically speaking, what can a court do when the order sought is impossible to achieve?

- Deceased estate finalisation, primarily owing to Master’s inefficiencies (like many state services) has become a problem and major banks are also now being blamed for such delays by Fisa.

- Fisa has also had a go at the changes brought about to the Trust Property Control Act which affects trust law as part of our government’s anti-money laundering efforts: https://www.tech4law.co.za/business/law-business-business/president-ramaphosa-signs-act-introducing-foreign-concepts-into-sa-trust-law/

- Practitioners have taken on the RAF on its practice directives; the case may be viewed at: https://drive.google.com/file/d/1ahQaPtc8FSI0avbGlep5udgTLAtHU4wF/view

- Last week the High Court in Pretoria dismissed an appeal against an interdict preventing the EFF from inciting people to trespass on private property.

- The Human Settlements bunch has had a go at banks over repossessions and sales of property, where the debt is less than hundred thousand Rand. I love the terminology – the Department “sensitised” the Banking Association about its concerns over the nature of such foreclosures.

Hard(er) news

- The uninitiated might want to read a short note on the share buy-backs: https://www.golegal.co.za/share-buyback-transaction/, the relationship between shareholders agreements and MOI’s: https://www.golegal.co.za/company-shareholders-agreement/, and dispositions without value dealing with insolvency law): https://www.golegal.co.za/disposition-value-insolvency/

- I could not find the case but the note written is interesting – concerning unfair dismissals relating to pregnancy: https://businesstech.co.za/news/lifestyle/651915/new-case-dealing-with-maternity-leave-in-south-africa/

- The following is a link to CCM a guidelines on misconduct arbitrations: https://www.lexinfo.co.za/post/ccma-guidelines-on-misconduct-crucial

Conveyancing

The amendments to the Sectional Title Act may be found at: https://www.gov.za/sites/default/files/gcis_document/201409/a29-03.pdf

Of particular interest are the amendments to sections 25 – 27 of the Act

Comment

There is mostly a difference between how others see us and how we see ourselves. Consider the following headline, which is funny simply because of what is going down in South Africa at present:

We are merchants of hope, says Ramaphosa of new ANC leadership ‘awash with wisdom’.

The “merchants of hope” bit is true insofar as what the ANC markets is hope, not necessarily results. However, “awash with wisdom”? Take our Minister of Energy Affairs and the planning that he was responsible for prior to our current economic disaster. Very little that mattered. It’s back to talk. Take for instance the undertaking to address the electricity shortage issues for small businesses; the fact is that a network serves an area, and you cannot restore power to a few individuals only.

The phrase “I don’t see colour” traditionally means that race is not a factor in the way one responds to people. Such colour-blindness is now slated as a form of racial denial which allows one to ignore manifestations of persistent discrimination and is therefore a reactionary racist concept. We do see race; the trick as to not have that influence how we treat others.

Quaint no more: the grandma and I had occasion to drive through the Free State this festive season, particularly on theR26, South of Fouriesburg. That road was so badly rutted and pot-holed that it cost us four dented rims and a new tyre. Such roads lead us to towns which were once quaint but is no longer so, owing to these simply not being maintained. In a similar vein, we now choose roads which are safe rather than convenient – would you willingly travel through Umtata? The fact is that State collapse, at all levels, has led to such failure of public services and the deterioration of public infrastructure, that the consequences affect all South Africans. So, those South Africans who are able, irrespective of race, will isolate themselves by going where governance works, services are rendered and will withdraw from any participation with our state. Polarisation is our future – we are driven thereto.

Lighten up

[It’s] hard to become a billionaire in public office… legally, anyway.

Pickens

A countryman between two lawyers is like a fish between two cats.

Benjamin Franklin

All lawyers are cut from the same cloth: fleece.

Neuman