Economy/business

Trends:

- Hearteningly, there appears to be green shoots in what had been rather dismal financial predictions of late. Y-o-y private sector capital expenditure in the last quarter is up by almost a third, FDI has been boosted by our clean-tech drive, loadshedding has ameliorated, tourism has recovered, employment is (marginally) up, Starlink is available in South Africa at prices discounted by about 30%, the World Bank predicts our 2024 GDP growth at 1.8%, and lastly, the legalization of weed, for private purposes, is in the pipeline (Whoopee Durbs!).

- NinetyOne reported that asset owners’ market conduct is back to normal.

- Powered up – small modular reactors off private venture capital could be in operation some 3 ½ years hence.

- The discussion on public sector wage growth has not waned. Whilst overstated, the claims of an over-paid civil service corps has not died off; statistics are available (https://codera.co.za/excessive-public-sector-wage-growth-is-the-problem/) which attribute the perceived overpayments to wages growing at a faster tempo than consumer prices.

- The hoo-ha surrounding our port inefficiencies have drawn the usual government response after the damage is done, in that our National Ports Authority has undertaken to work on improving things. The latest in the saga is that demurrage delays cost us money, the Cape Town port crisis has led to authorities actually considering pulling in private contractors and so on. What rubbed in the above inefficiencies, is our Durban and Ngqura ports being ranked 365th and 361st out of 370 ports, worldwide, by the World Bank last year.

- The not-going-to-happen-in-my-lifetime (because of lack of funds?) NHI might well be funded in part by culling private sector medical aid tax deductions. This caused a minor rumpus for taxpayers. But, rest assured, I have little doubt that the savings/takings will go into savings to pre-fund the NHI… ????

- The ongoing struggle to attract highly qualified technicians/professionals into our country precipitated a comparison reflected in the 2023 Global Talent Competitiveness Index, which index evaluates the ability of countries to attract, develop and retain skilled individuals. Out of the 134 countries ranked, we have dropped from the 60th possession last year to 68th position now. Switzerland is tops and we rank directly below Kazakhstan, Jamaica, Moldavia and, believe it or not, even the Ukraine: https://www.insead.edu/system/files/2023-11/gtci-2023-report.pdf

- Not quite an admission of guilt… but; Standard Chartered has settled with our Competition Commission on a charge of fictitious bids and collusion on the R/US$ exchange rate. Nice…

Practice

News:

- Prisoners are now allowed (modem-less) laptops in cells per the SCA.

- TIA: the State Attorney has to recover legal costs from Nummawan before May 2024 lest its claim prescribes; no bets accepted on whether this will be seen through.

- I was quite interested to read that banks have a problem in combating home loan fraud as, on the face of it, this would be quite hard to pull off, given the checks and balances in the system. This is how it is done: https://www.moneyweb.co.za/news/south-africa/banks-making-inroads-in-combating-home-loan-fraud/

- GroundUp reports that the number of reserved judgements in our high Courts, which have been outstanding for longer than six months, is the highest since December 2012. Special mention should be made of the Johannesburg Labour Court, and the Pretoria and Pietermaritzburg High Courts!

- RAF

- This institution should be nominated as newsmaker of the year: the latest is that Discovery will go after its the RAF CEO for contempt of court – I have little doubt that most practitioners would wish it g*dspeed.

- An RAF Board Notice which had excluded certain victims from claiming compensation from the fund has been declared unconstitutional by the Pretoria High Court. Yawn.

- Practitioners may find a court order on the submission of RAF claims interesting: http://www.saflii.org.za/za/cases/ZAGPPHC/2023/1843.html (ex Robin)

- Payouts by this fund is up 17% on the figure in 2019/20.

- Practitioners will recall that the RAF had fired all its attorneys and had sought to do the work itself. Recanted, pleasingly; its panel of practitioners has been published and, should you want a copy, ask me. (Ex Robin)

- Practitioners should renew their FFund certificates for the New Year: use the link https://ffc.fidfund.co.za/

- An interesting aside from the Meyiwa trial, is that the state was allowed to use car tracking evidence to dispute the accused’s whereabouts.

- Note that crypto assets are traceable: https://www.moneyweb.co.za/moneyweb-podcasts/money-rules/should-you-include-a-living-trust-in-your-estate-plan/

Hard news:

- Can you, in an ANC, waive the right to claim maintenance? https://www.phinc.co.za/OurInsights/ArticleDetail.aspx?Title=Navigating-spousal-maintenance-in-your-Antenuptial-contract

- Not everyone’s cup of tea, but a guideline on what is required for the amalgamation of two companies: https://ajmtax.co.za/documents-required-for-the-implementation-of-an-amalgamation-transaction/

- An evergreen source of disputes are restraints of trade. Two articles follow – the first on the retention of skills within the mining industry; the second on the transferability of a restraint under section 197 of the LRA:]

- https://beechveltman.com/employment/attracting-and-retaining-key-skills-within-the-mining-industry-are-restraints-of-trade-effective/

- https://www.cliffedekkerhofmeyr.com/en/news/publications/2023/Practice/Employment/employment-law-alert-6-November-take-note-of-your-vows-a-couples-transfer-of-employment-and-enforceability-of-restraint-of-trade-agreements-

- A recent note on Moneyweb dealt with estates and discretionary inter vivos trusts; unfortunately the note is somewhat too general – what most persons would want is a guideline on at what estate value such a trust, given the cost of running it for the interim, would become worthwhile, all taxes considered: https://www.moneyweb.co.za/moneyweb-podcasts/money-rules/should-you-include-a-living-trust-in-your-estate-plan/

- Those involved in water rights for farm/forestry use should read this judgement: http://www.saflii.org.za/za/cases/ZASCA/2023/153.html

- The requirements for special leave to appeal may be found at: https://www.cliffedekkerhofmeyr.com/en/news/publications/2023/Practice/Dispute/dispute-resolution-alert-14-november-how-special-is-special-when-determining-special-leave-to-appeal

Conveyancing:

The Pietermaritzburg Deeds Registry will have no set deadline for the lodgment of deeds which are guaranteed to be registered before Christmas. A double execution will be held on the 20th December, with the 21st being a normal working day (read mop-up). As usual, little will happen on the 22nd!

Property

Trends:

- The reality of high interest rates being with us for a while has had and will have a dramatic impact on the property market for a while still.

- Tyson’s CEO was interviewed by Moneyweb and he said that:

- the entry-level housing market is depressed, owing to in-affordability, given high interest rates and so on;

- the higher end (R3.5m+) residential market is stable;

- upcoming younger persons and professionals prefer to rent rather than buy, as it keeps them mobile; hence the rise in rentals rather than purchases; and

- the residential market will probably muddle on at its current levels for at least the next year before any serious residential property boom can be expected, owing to, interest rates stabilizing but not dropping meaningfully.

- Having said this, Redefine, our biggest REIT, says that our property market is at an inflection point having been an investment dog since 2017, owing to rising interest rates. It appears that ‘operating matrixes’ (????) are stabilizing and the outlook for normalization is positive.

- The office property sector will need a substantially higher GDP growth rate (3%) than that predicted for next year, in order to recover.

- FNB/Loos has restated the obvious: the Western Cape Property market outperforms the rest of our country substantially on the back of better service delivery. Afstig is an Afrikaans tradition and could be extended to provinces rather than just churches!

- An interesting development, new in the sense that it has, to my knowledge, never been institutionalized before, is Balwin announcing that it would allow prior purchasers to trade in old apartments for new ones. This would save advertisement/agency costs but would carry quite high transaction costs for the purchaser as transfers will be required.

Comment

Will your children do better than you did? The following article comes with an expected result but is interesting in that one sees that the issue at hand is not particular to South Africa – ours is all the more alarming when one looks at our unemployment rates. Government spending is but one factor in quite a complex question: https://johanfourie.substack.com/p/how-much-education-do-you-inherit?

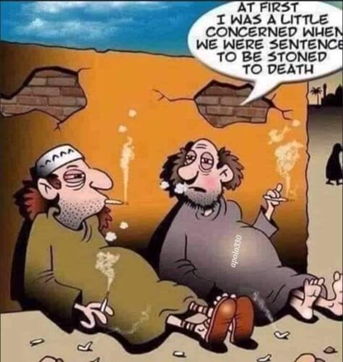

Lighten up

On Dbn Poison:

- You can’t spell healthcare without “THC.”

- Weed go well together.

- This should be a joint decision.

- Chicken pot pie. These are my three favorite things.

Written by: Daan Steenkamp

Still looking for your dream home, or wanting to sell? Feel free to give one of our developers a call today.

Tom Eastwick – The Gates, Hilton and Garlington, Hilton | 072 297 2699 | tom@devdirect.co.za

Janet Channing – Waterford Residential Estate, Howick | 082 570 5834 | janet@devdirect.co.za