Business

Trends:

- Our SARB Governor says that our economy is not growing – at 0.6% growth thus far this year – and our living standards are falling. Taking inflation into account it is said that South Africans now earn on average what we did in 2006. Growth is limited to government debt!

- The above sentiment is echoed by –

- the SA Chamber of Commerce trade survey in which 69% of respondents said that trade conditions in February were worse than a year ago;

- business cycle indicators being down for the third month in a row;

- the BER Retailer Confidence index dipping in the first quarter of this year; and

- agriculture confidence remaining at a low level.

- Good news, of sorts, are –

- the ABSA PMI rebounded to 51.7 in February;

- the FNB/BER Civil Confidence index for Q1/2024 has recorded its best level since Q3/2016 with almost 50% of those surveyed satisfied with the prevailing business conditions.

- the Bank of America announcing that it expected a credit upgrading for SA this year;

- Infrastructure SA announced an infrastructure book of projects worth R158bn; and

- SA is running a positive trade balance.

- An interesting sidenote is that the Bureau for Food and Agricultural Policy has, twice this year, questioned Stats SA on its statistics for the agricultural sector, saying that the statistics ‘are not supported by evidence on the ground’, and pointing to ‘challenges’ within the QLFS. If correct, questionable statistics may persuade those who lead us to take incorrect decisions. Whilst on this topic, the 20-year Treasury/Oracle spend saga, recently criticised by SCOPA for being irregular and wasteful, hardly indicates competency of those who point the way to our economic future.

- Efficiency? We spend 0.76% of GDP on public transport subsidies and 12% of GDP on transport-related costs (as opposed to an average of 7% spent by countries with comparable transport systems), some 56% of which is allocated to rail and 43% to bus transport. These subsidies reach a very small percentage of our workforce, meaning that much of our spend is does not reach the intended target.

Notable news:

- Tax: an oft repeated sentiment on tax rates and government income, has again made news: our tax revenue has grown by some 89% over the past 10 years. Good, but the heading difficulty with this is that corporate tax revenue has grown significantly more slowly than personal income tax, meaning that the slice of government revenue generated from personal income tax currently stands at around 40%. Personal income tax (paid by only 12% of our population) increased by 109% over the same period.

- Four new banks will launch in the next few years. Of our current bunch,

- The ‘prescribed asset’ imposition on financial institutions investing RAs, is intended to tap private money to fund public spend shortfalls. In most situations, commendable, except where confidence in the management of such projects is justifiably bleak. You have to love this statement by the deputy chair of the ANC’s Economic Transformation Committee:

‘The intention is not to arbitrarily take a decision about which class of assets should be invested in, or to even design those, but it is to have a broad conversation with all the relevant stakeholders to pose the question about whether the ambition for national growth, that we all share, could be better realised with an increased threshold of domestic investment from our pension-fund sector.’

This sounds utterly reasonable except against a background of the state being unable to run anything financial.

Practice

News

- Our Legal Services Ombud has requested comments on draft rules for the functioning of his office.

- RAF: our evergreen newsmaker has been at it again –

- the RAF obtained an interdict from the Labour Court against a planned Numsa strike this Thursday past;

- the RAF/Discovery imbroglio drags on in that the contempt of court application against the fund, has been stood down awaiting a hearing by a full bench.

- The RAF thwarted another attempt by a creditor to seize R113m worth of its assets meant for auction.

- Our High Court in Pretoria found that the Minister of Transport’s directive excluding foreigners, involved in accidents, from accessing RAF funds, illegal.

- Lawyers misbehaving:

- You will recall that two SCs had been convicted in Namibia for contravening that country’s Immigration Controls Act. Now, the LPC has waded in and will investigate. I confess that I am amazed at that August body’s newfound alacrity.

- Colleagues headed up a bid to block disciplinary proceedings against the National Lotteries Commission company secretary, which attempt was punished by costs on a punitive scale, and judicial comment that “attorneys are duty-bound to advise clients on the prospects of litigation”. A reminder or not he did much of late!

- A comment by a (black) Pretoria High Court judge on the reprehensible behaviour of “black lawyers”, resulted in an apology by the relevant judge. Funny.

- More on judges! Another judge became so bored that he “took a break” during the testimony of a witness and was removed from the case for so doing!

- Grinding on slowly: a Chief Magistrate will be fired after having been found guilty of a rude and threatening behaviour by the Magistrates Commission. As aside: are we reporting more readily on such issues or is lawyering in general not what it used to be?

- An aside, which I found quite disturbing, was a note by The Citizen saying that Min Gordhan had threatened legal action against Parliament to prevent the SIU from investigating the SAA deal. Something to hide?

- An article, written by a young presumably coloured/black advocate on discrimination, bears reading: chrome-extension://efaidnbmnnnibpcajpcglclefindmkaj/https://gcbsa.co.za/law-journals/2023/december/p%2075%20-76.pdf

- An interesting development on the Intercape bus attacks, suggests that a taxi boss may have been at the centre of this disruption.

- Zondo and Ramaphosa are reportedly engaged in talks on boosting judicial independence. Interesting; I had, until recently, assumed that our courts were independent.

- The investment arm of the BMF has been in the spotlight as that organisation had filed an application to the Gauteng High Court to declare ten of the directors of the investment board of that entity, delinquent. The difficulty appears to be the R10k fee for attending meetings!

- Not only police buildings are in bad form – a newspaper ran an article on a Pietermaritzburg attorney who refused to appear in our Magistrates Court as the conditions were deplorable and unbearable – attaboy!

Hard news

- A note by Herold Gie on liability for defamatory Internet posts, is interesting as opinionated posts by “influencers”, seeking notoriety are all the rage : https://heroldgie.com/influencers-beware/

- May a psychologist release counselling records to either of a couple who are engaged in a legal dispute? https://www.macrobert.co.za/insights/posts/how-should-psychologists-respond-to-requests-for-access-to-couple-therapy-records

- Pothole liability: as predicted, in a recent case the North West MEC for Public Works and Roads, has been found to be liable for 100% of the damages incurred by a traveller in a pothole-related accident that happened in 2018. Wait, more must be coming!

- Lack of road maintenance is accompanied by lack of the maintenance of road fencing: the following note deals peripherally with this: https://www.phinc.co.za/OurInsights/ArticleDetail.aspx?Title=How-liable-is-an-owner-for-damage-caused-by-animals

- Can one commission affidavits virtually? https://www.saflii.org/cgi-bin/disp.pl?file=za/cases/ZAGPJHC/2024/311 ex West

Conveyancing

- I repeatedly receive transfers in which the causa is a donation: the following may be of interest: https://www.sdblaw.co.za/OurInsights/ArticleDetail.aspx?Title=Why-a-clean-donation-can-have-sticky-consequences&utm

- Should one specify that assets be converted to cash on death – and lose the CGT roll-over benefit that an heir might have? Ask me for the article.

Property

Trends:

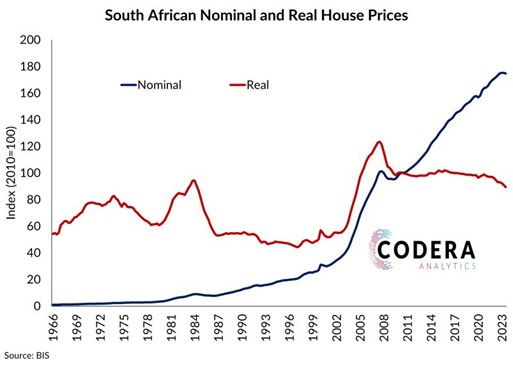

- The FNB House Price Index averaged 0.7% yoy in February. Predictions are that low levels of house price appreciation will persist in the near term. Having said this, my perception, from a practice perspective, is that buying activity has tended slightly higher of late. The following graph shows that house prices have been rising slower than consumer prices since 2008:

- Exceptions to the above are Cape Town and Soweto.

- Residential rentals still lag inflation, with the Western Cape and Gauteng best off.

- The price of sectional title homes is increasing at a faster pace than freehold properties, with such homes proving to be the most popular type of property in South Africa of late. Sectional title sales account for virtually two thirds of all investment properties sold last year. Affordability, security, communal facilities, and lock-up-and-go are the main attractions of such properties.

- The MSCI Quarterly Retail Training Density Index shows a yoy trading density deceleration, in retail centres, of some 2% in the previous quarter.

- Municipal billing backlogs are still burgeoning with the total of unpaid bills ballooning from R87bbn in June 2023 to R313bn in June last year. This and municipal dysfunction have led to statistics (collected by Codera) showing that no province has spent more than 2% of the value of municipal assets on maintenance and repair, since about 213 to 2019; a clearly untenable situation.

- Whilst on municipalities: BusinessTech published an evaluation of best/worst municipalities – if this interests you: https://businesstech.co.za/news/government/763417/the-best-and-worst-run-municipalities-in-south-africa/

News:

- Discovery will launch home loan offerings in April, focusing on its client base, which represents some 20% of the entire mortgage market in South Africa.

- Much has been said about EWC, but, if looked at objectively, the threat is probably not as potent as commentators suggest (see page 64): chrome-extension://efaidnbmnnnibpcajpcglclefindmkaj/https://gcbsa.co.za/law-journals/2023/december/p%2063%20-%2065.pdf

- Land reform returned 19.3m ha, or its cash equivalent, (of some 77m ha) farmland to blacks, in one form or another, to date.

- Whether fixed property is an asset that retains its value in hard times, is debatable, but the following is worth looking at, as Zimbabwe had gone there before us: https://www.moneyweb.co.za/moneyweb-podcasts/the-property-pod/whats-happening-in-zimbabwes-property-market-may-surprise-you/

To know:

- Can a body corporate write off levy arrears? Yes, provided it gets a unanimous resolution: https://www.paddocks.co.za/paddocks-press-newsletter/can-a-body-corporate-write-off-levy-arrears-interest-and-legal-fees/

- Are electronically signed sale agreements valid? Probably not: https://www.phinc.co.za/OurInsights/ArticleDetail.aspx?Title=To-click-or-to-ink?-Are-electronically-signed-sale-of-property-agreements-valid-in-SA

- Can/should contractual undertaking for payment of sales commission on cancellation of a sale be enforced? https://www.fluxmans.com/article/we-shall-fight-them-breaches-steven-fisher

- Does early termination of a lease contravene section 14 of the CPA? https://www.saflii.org/cgi-bin/disp.pl?file=za/cases/ZAGPJHC/2024/311 ex West

- The following case is an example of the City of Johannesburg being taken to task for very sloppy litigation: https://www.saflii.org/cgi-bin/disp.pl?file=za/cases/ZAGPJHC/2024/291.html

Comment

About a year ago the recently installed SWMBO took me to see the Parliament buildings in Pretoria. The road there was marked by broken and hastily repaired fences and breaches in road edging. In the week past, the SAP head office in Pretoria had to be abandoned owing to its neglect. One cannot blame this on just Public Works; the chief of police and, indeed, parliamentarians, must see this neglect daily. Yet, nothing was done by those in charge. Why? Yet those in charge, speak of others being held to account, whilst they clearly aid and abet neglect.

Lighten up (on potholes)

The guys fixing the potholes on our road have completely disappeared.

I have no idea when they’re going to resurface.

What do you call a man with no arms and no legs in a pond?

Bob.

What do you call a man with no arms and no legs in a pothole?

Phil.

Written by: Daan Steenkamp

https://www.daansteenkampattorneys.co.za/

Still looking for your dream home, or wanting to sell? Feel free to give one of our developers a call today.

Tom Eastwick – The Gates, Hilton and Garlington, Hilton | 072 297 2699 | tom@devdirect.co.za

Janet Channing – Waterford Residential Estate, Howick | 082 570 5834 | janet@devdirect.co.za

#retirement #gatedestate #luxuryliving #midlandsliving