Gentle Reader,

Last weekend I attended a local boeredag on the far side of the Boereworsgordyn, which reinforced my local detribalisation. SWMBO and I approached the venue walking through a sea of BIG bakkies, nary a sedan in sight.

“Gee my n F250..en n 308 wat nie mis nie..” A Boere-Rock band is belting out this song as we walk into the huge (70 x 35m?) tent (following with a generous mix of religious/stout and land/farming aggrandisement songs). The serious business done, an auctioneer is in the process of auctioning off toys for R150k each, and more, for the benefit of local charity; you can smell the money, the confidence and generosity that it brings.

A local purchaser points out five farmers; tells me that their combined harvest income, in the previous season, was R750m – their farm sizes are in the region of 15000ha each. ROI is some 20%?? Do the sums – these guys are seriously big boys; running an enterprise like that requires big cojones and a big cheque book. Oh yes –only kortbroeke in sight! No airs and graces; gemoedelik.

No, I am not disparaging the Engelse (I have friends who have Engelse friends ) but, seriously, these guys had a presence that our local farmers cannot begin to match.

Daan

Economy/business

Trends:

- Inflation is easing (The Shisa Njama index says so!) but our consumers are not generally in great shape.

- Consensus holds that the first six months of this financial year will be much like the end of last year – we had narrowly escaped recession. Bank rates are expected to ease later than predicted, with a recovery of sorts coming later this year, with expected growth of 1 – 1.4%. This

- The result of this is that banks are expected to tighten up on lending.

- The RMB/BER business confidence index has ticked down to 30 which reflects a tepid market.

News snippets of passing interest:

- Tall poppy syndrome? Safair has been taken on by competitors on the same ownership issue that was scuppered some time ago. Presumably the result will be the same?

- One’s immediate reaction to the widely publicised CIPC data breach is that such neglect is an Africa thing; listening to prof Van Solms, it is clear that hackers can get into almost anything – vide the US government agencies having been hacked not long ago.

- Municipal dysfunction is particularly noticeable of late – our state regrettably contributes to this; a BusinessDay report held that state departments owe municipalities R22bn! However, payment of these arrears would hardly dent the some R7220bn, that SADAC estimates, is required to address critical infrastructure in the next 15 years.

- BEE:

- The premium that is paid for transformation in the public procurement sector, is calculated at R80bn by Prof Migiro (UKZN). This is serious investment in the future and one hopes that it will pay off?

- Wall Street/Goldman Sachs appears to have abandoned its preference stance on minority workers.

- If we were to expand our electricity distribution grid, to accommodate private sector electricity transmission, it would cost R350bn over the next 10 years – Eskom’s chairman wants the private sector to pay for this but the state owns the grid. Question: how does one enforce payment against the state?

- A Phoenix from the 2019 ashes: the hoo-hah about pensions investing in prescribed assets, is confidently said to be exaggerated (by the Deputy chair of the ANC’s economic policy formulation subcommittee – note, not the state): we will buy state bonds rather than invest directly; definitely safe!

- We will require two new universities i.e., a policing ‘varsity in Hammanskraal, and a university of science and innovation in Ekurhuleni.

The following is interesting:

- The so-called Osborne Effect provides an interesting lesson on consumer reaction: if you promise a wonderful new product, but cannot deliver now, the loss in sales, to those awaiting your new product, might well bankrupt you in the interim.

- Table Mountain has made it to the new 7 Wonders of the World

- A Labour Court (presumably Port Elizabeth) held that if you come to an arrangement for an employee, to work beyond the accepted retirement age, even on a fixed-term contract, you cannot use age as a reason for terminating their employment before the expiry of that term.

- If you produce what another produces, but you are very diligent et cetera, is this a good thing – is the harder worker a better person? https://www.ted.com/talks/azim_shariff_does_working_hard_really_make_you_a_good_person?

- Can culture justify absence from work? Consider initiation, religious holidays and such: https://www.dupwest.co.za/OurInsights/ArticleDetail.aspx?Title=Can-you-use-your-culture-to-justify-being-absent-from-work?

Practice

News:

- SARS made the news recently when newspapers reported that it was attempting to hold Sasfin liable for the actions of some of Sasfin’s employees, who allegedly colluded with a criminal syndicate to expatriate money illegally. The sum involved is R4.9bn. Atta boy; a bonus for our profession!

- The RAF’s seemingly perpetual newsworthiness continues: this time over –

- a recommendation that compensation for loss of income arising from non-serious injuries should be scrapped; and

- its board being severely criticised for failing to withdraw a decision to institute action against the AG. …yawn.

- Our police minister was held liable by the Pretoria High Court for R93m, lost to Lloyds, after SAP members assisted in a cash heist while on duty! Now we know how much money these guys transport!

- Gender disparities in our profession has taken a backseat of late, but, on International Women’s Day, this topic resurfaced, with reports saying that there is a significant lag in the progression of women to leadership roles, compared to their male counterparts.

- Mediation cannot be enforced if a party will not join in. The prospect of an adverse costs order, may assist in bringing an unwilling opponent to the mediation table: https://www.macrobert.co.za/insights/posts/why-you-should-consider-mediation-as-opposed-to-litigation

- Our Concourt recently ruled that it is not discriminatory to require legal practitioners to be citizens: https://www.derebus.org.za/rational-distinction-debdebated-on-the-legal-practice-act/

- Don’t take on work in Namibia, after entering that country as a visitor: https://www.citizen.co.za/news/legal-blow-for-ex-zuma-lawyers-namibian-court-upholds-convictions-in-immigration-case/

Hard news:

- Two novel legal arguments surfaced recently:

- A surety sought to escape liability by arguing that the debtor and creditor colluded to dispose of certain assets, which it argued triggered section 31 (2) of the Insolvency Act; not successful but certainly interesting : https://www.cliffedekkerhofmeyr.com/en/news/publications/2024/Practice/Dispute/dispute-resolution-alert-27-February-2023-collusion-between-debtor-and-creditor-defence-for-a-surety-

- A CGT shlenter involving two foreign trusts and the revaluation of assets to avoid tax; for tax nerds only: https://www.webberwentzel.com/News/Pages/revaluing-trust-assets-to-avoid-capital-gains-tax.aspx

- Are you entitled to set off collection entitlement against proceeds received from an insolvent estate, prior to paying this over to the liquidators? https://www.werksmans.com/legal-updates-and-opinions/8954/

- When disputing an administrative decision, may a court substitute its decision for that taken by the official? https://caf.co.za/the-prospects-of-obtaining-a-substitution-order/

Conveyancing

- The annual increase in deeds office taxes (I wouldn’t call these fees) has been published and will come into operation on 1 April.

- Conveyancers should note that the commercial deeds search engines, that we pay for, do not always provide accurate information. I have repeatedly found that information obtained from the commercial sites, do not match that obtained directly from our local deeds office. Be careful.

Property

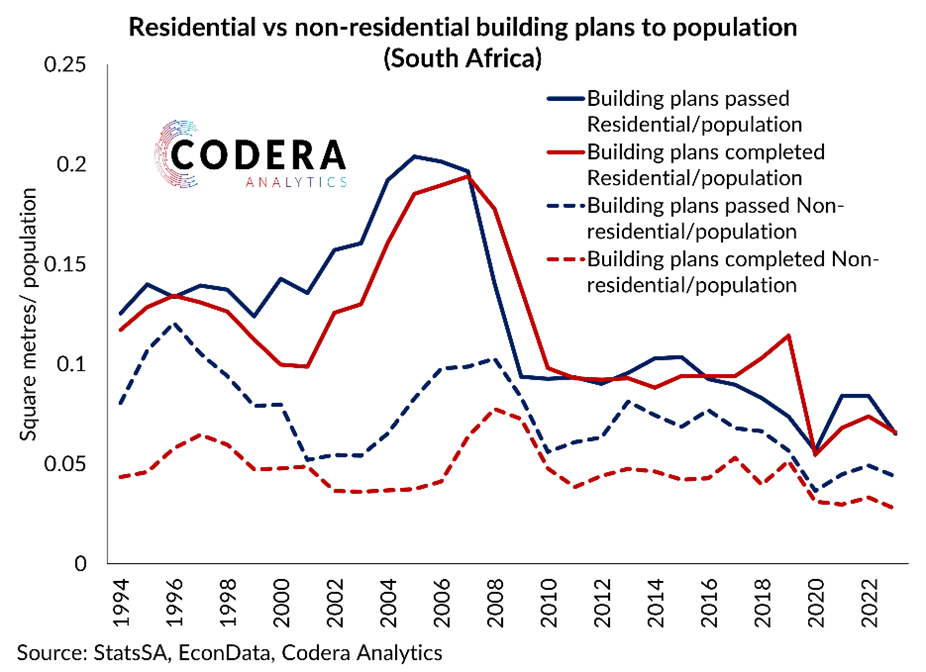

Our seemingly endless cycle of interest rate fluctuations, predictably stymied the purchase of residential properties for consumers. In turn, this led to a significant decline in residential building plans, as may be seen from the following graph:

Our growing middle class cannot afford houses and must needs rent, which, in turn, has now stimulated the buy-to-let of residences. It is said that, typically, 4% of home loan applications relate to some form of buy-to-let, whilst we have seen spikes reaching 11% in such purchases over the past few years. Ooba says that, in the Western Province, 28% of its applications for loans, relate to such investment property applications. The following graph, also by Codera, shows the relationship between the growth in the rent and property prices over the past 12 years:

From the above, the following interesting snippets arose:

- Ooba says that the Eastern Cape overtook the Western Cape three years ago as the region with the highest volume of applications for holiday home

- Women possess some 60% of our country’s residential housing stock. Betterbond says that more single women than single men apply for housing bonds, which echoes Lightstone’s findings, over a period of five years, that more women purchase property on their own than both men or married couples.

Two recent articles are worth noting:

- Moeletsi Mbeki endeared himself to the white minority in the past by expressing the sentiments which whites cannot– this time saying that whites had not stolen land (per Mr Malema) but had conquered the locals to take that land off them.

- Few middle-class consumers can afford to hold residential property in a trust. A short note on the costs of such holding may be found at https://www.primediaplus.com/tax-implications-of-transferring-property-into-a-trust-explained/

Comment

(Oh) My lord! An interesting debate arose recently, after a judge had questioned the racial make-up of a team appearing before him, and an SC defied him. The horns of the dilemma are these: judges are not ordinary people and deference/respect is required. Yet judges are human and make mistakes. Experienced litigants confront this daily; one may differ from others who may be senior to you, but with respect. This applies to both those on the bench and those who appear before them.

Lighten up

Woody Allen:

“When I live my next life, I want to live it backwards. You start off dead and get that out of the way. Then you wake up in an old persons’ home feeling better every day. You get kicked out for being too healthy, go and collect your pension, and then when you start work you get a gold watch and a party on your first day. You work for 40 years until you’re young enough to enjoy your retirement. You party, drink alcohol, and are generally promiscuous; then you are ready for high school. You then go to primary school. You become a kid; you play. You have no responsibilities; you become a baby until you are born. And then you spend your last nine months floating in luxurious, spa-like conditions with central heating and room service, on tap, larger quarters every day and then Voila! You finish off as an o….”

Written by: Daan Steenkamp

https://www.daansteenkampattorneys.co.za/

Still looking for your dream home, or wanting to sell? Feel free to give one of our developers a call today.

Tom Eastwick – The Gates, Hilton and Garlington, Hilton | 072 297 2699 | tom@devdirect.co.za

Janet Channing – Waterford Residential Estate, Howick | 082 570 5834 | janet@devdirect.co.za

#retirement #gatedestate #luxuryliving #midlandsliving